Banza Corporate Lending for Creatio

Intelligent product for corporate and SMB lending process acceleration

Overview

Product overview

Product description

Corporate Lending for Creatio is a ready-to-use solution that helps increase the speed of loan provisions with end-to-end lending management processes, covering the customer journey from lead consulting to credit committee decision and agreement signing.

Use cases:

Improve your "time to yes" and "time to cash" through accelerated lending automation for small, medium, and corporate businesses.

Banza Corporate Lending for Creatio is best-suited for finserv institutions to manage corporate lending processes of different segments at all stages. With this solution, users can customize an unlimited number of workflow scenarios easily and automate and control each stage of the loan application process.

The solution includes:

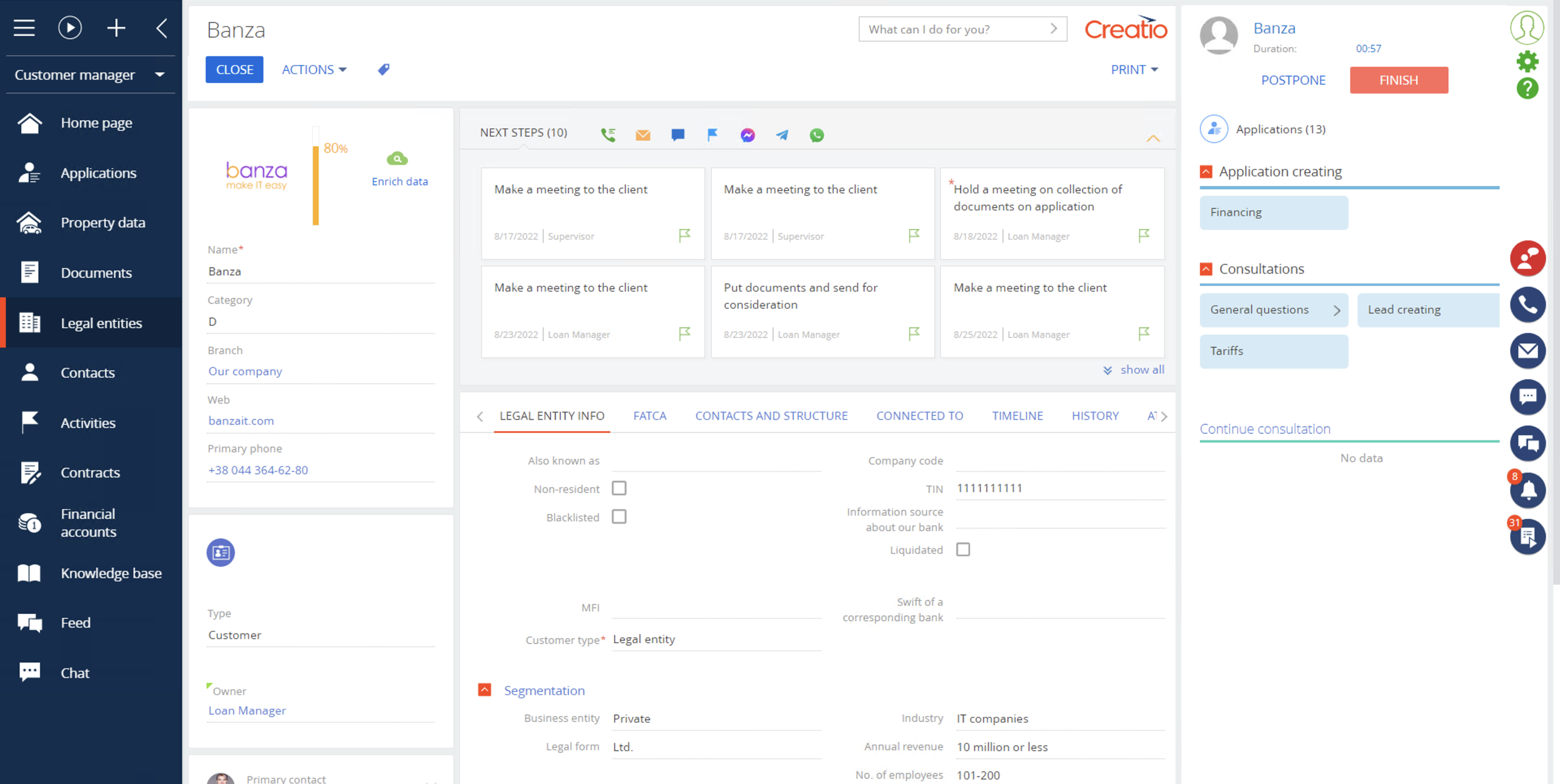

- Customer needs management (leads to legal entities)

- Client info searching and editing

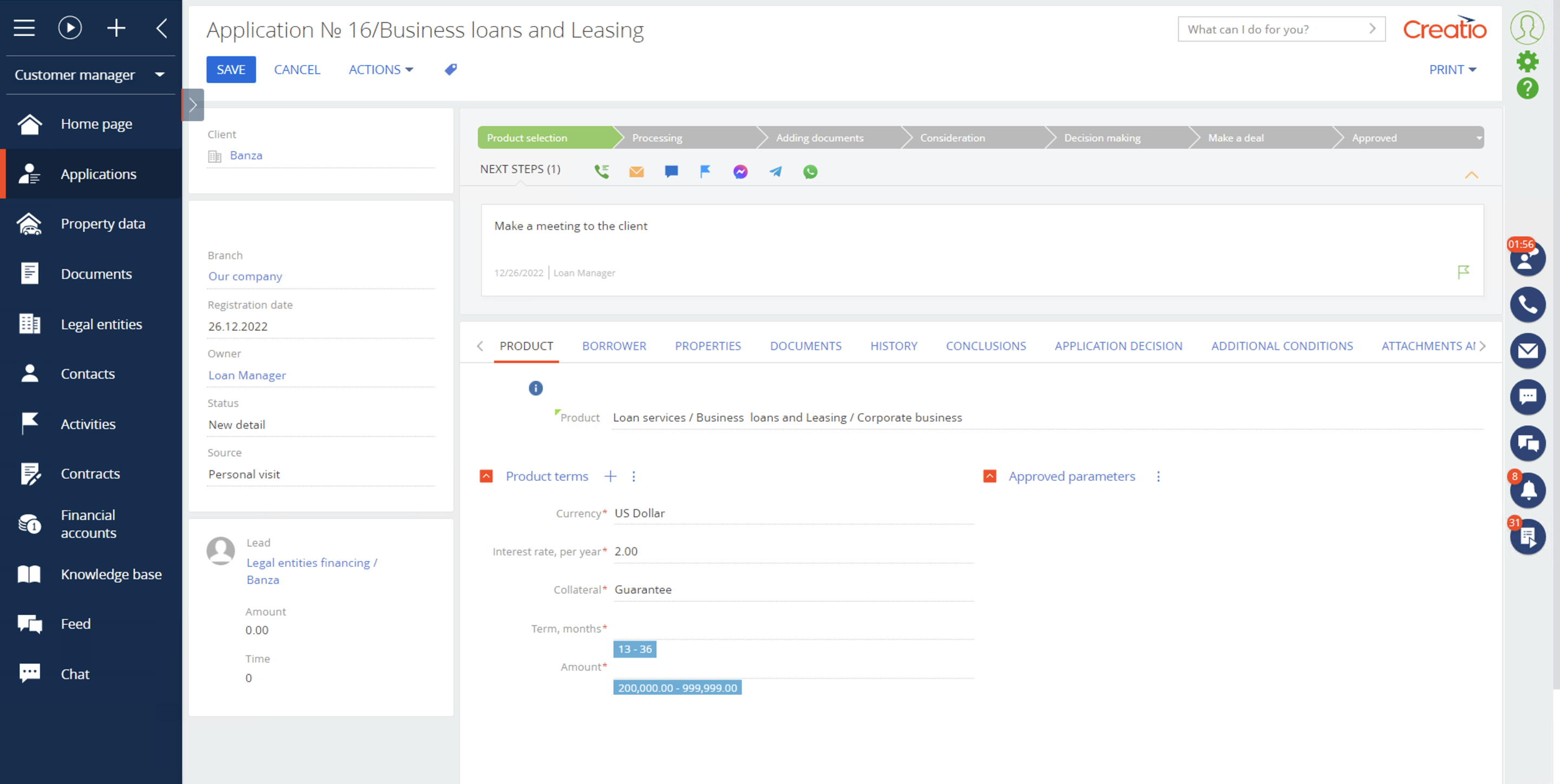

- Selection of product conditions

- Development of questionnaires for different application participants

- Collateral property management

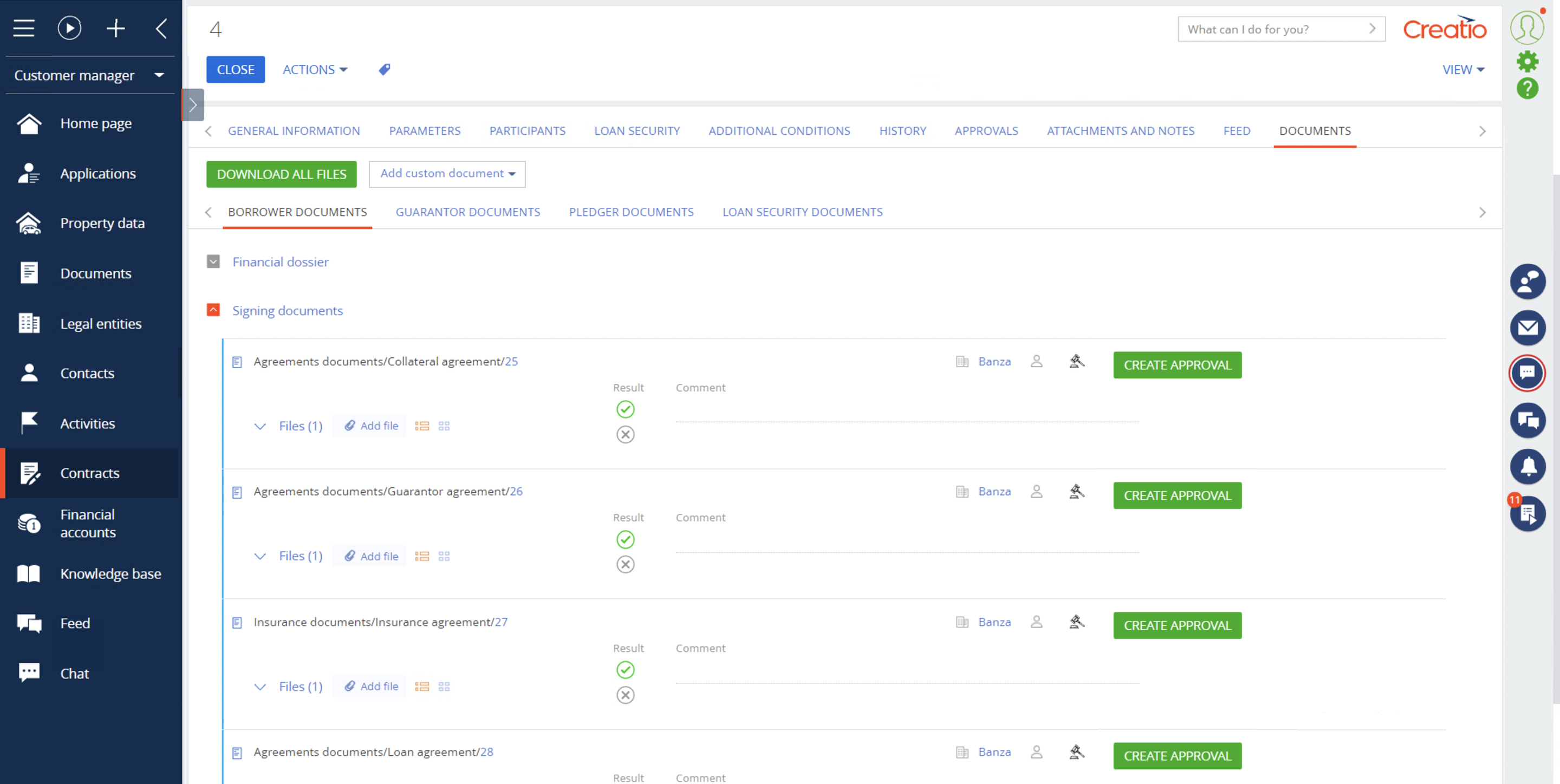

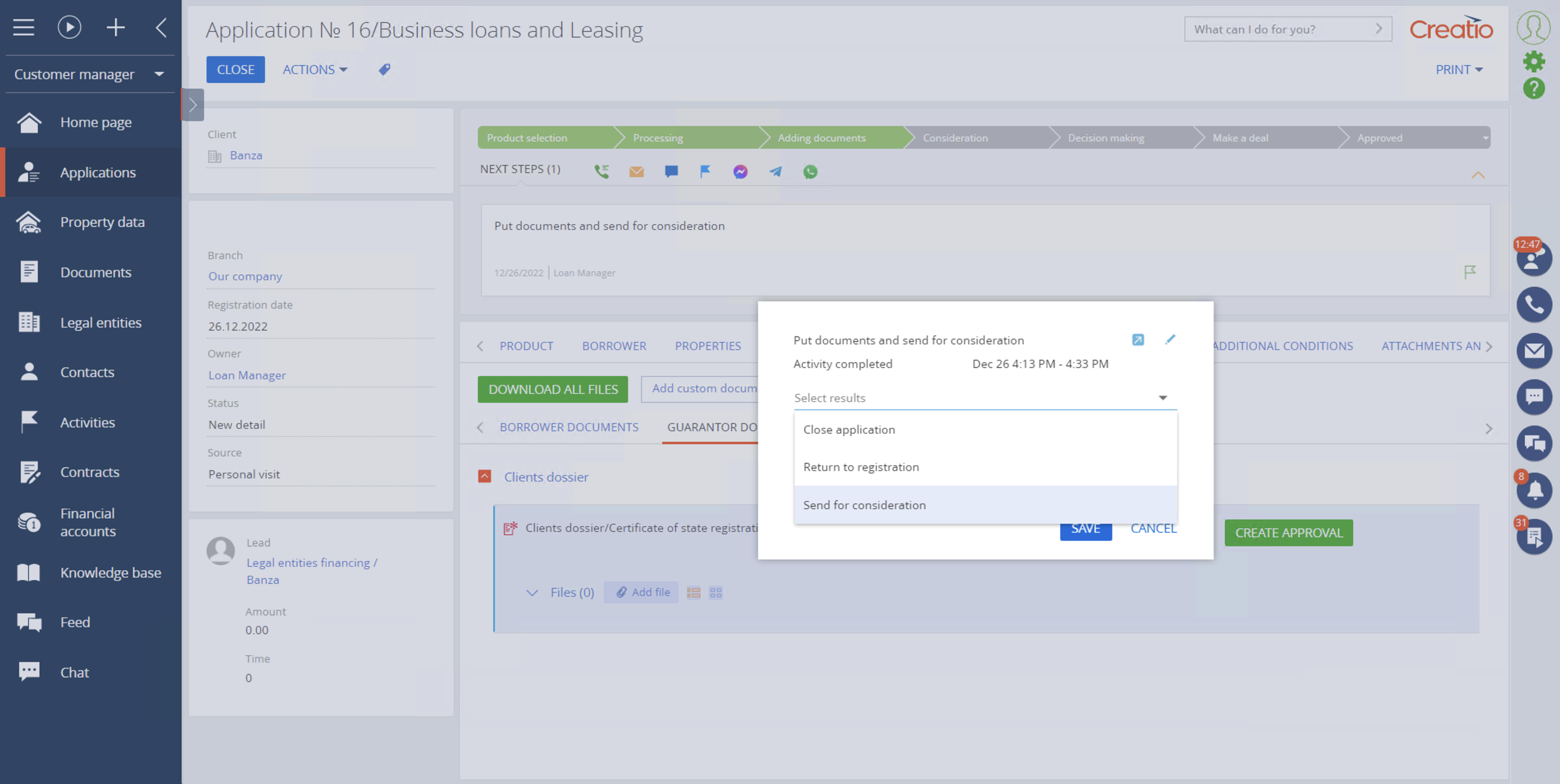

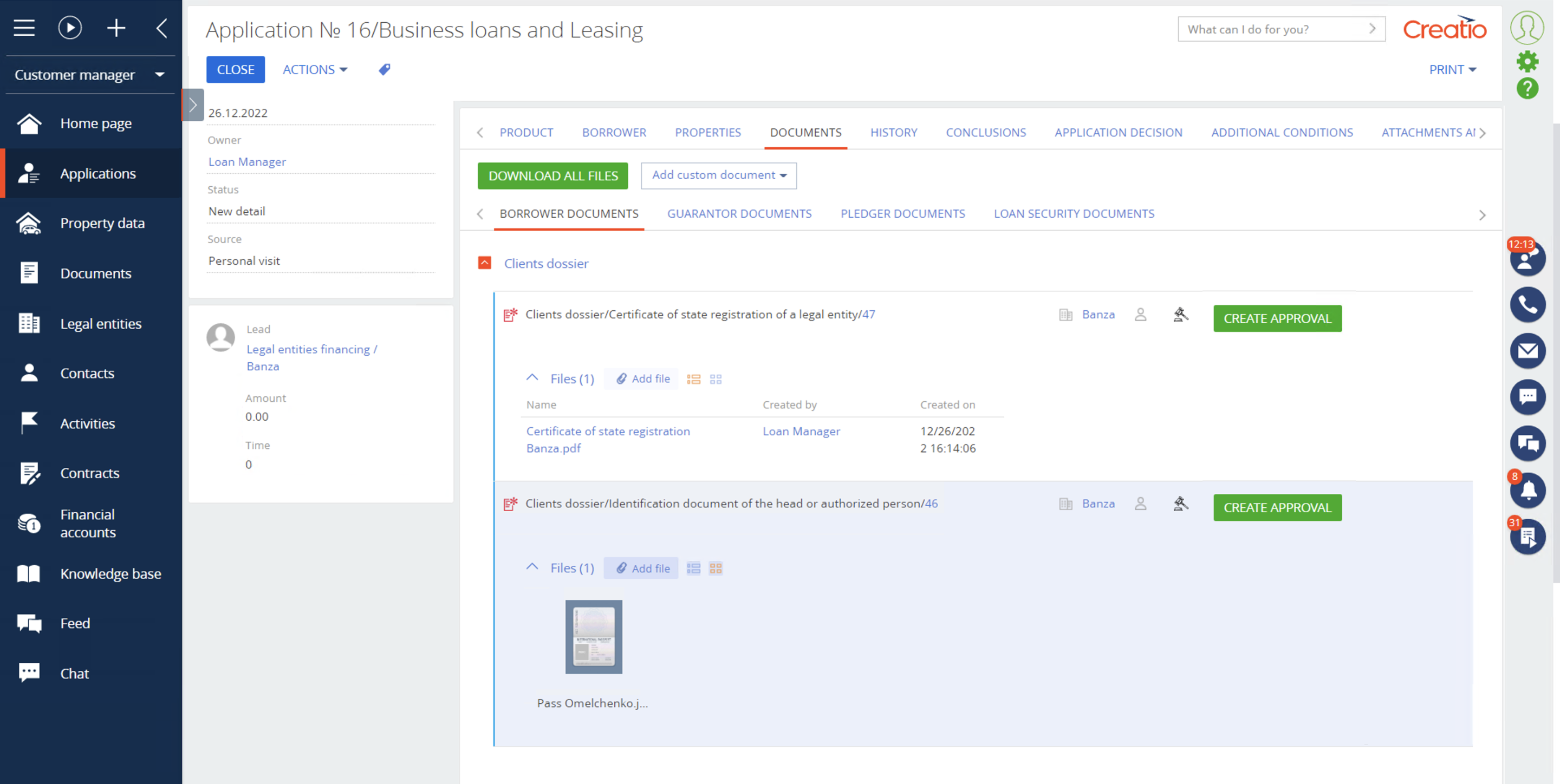

- Loan document flow management

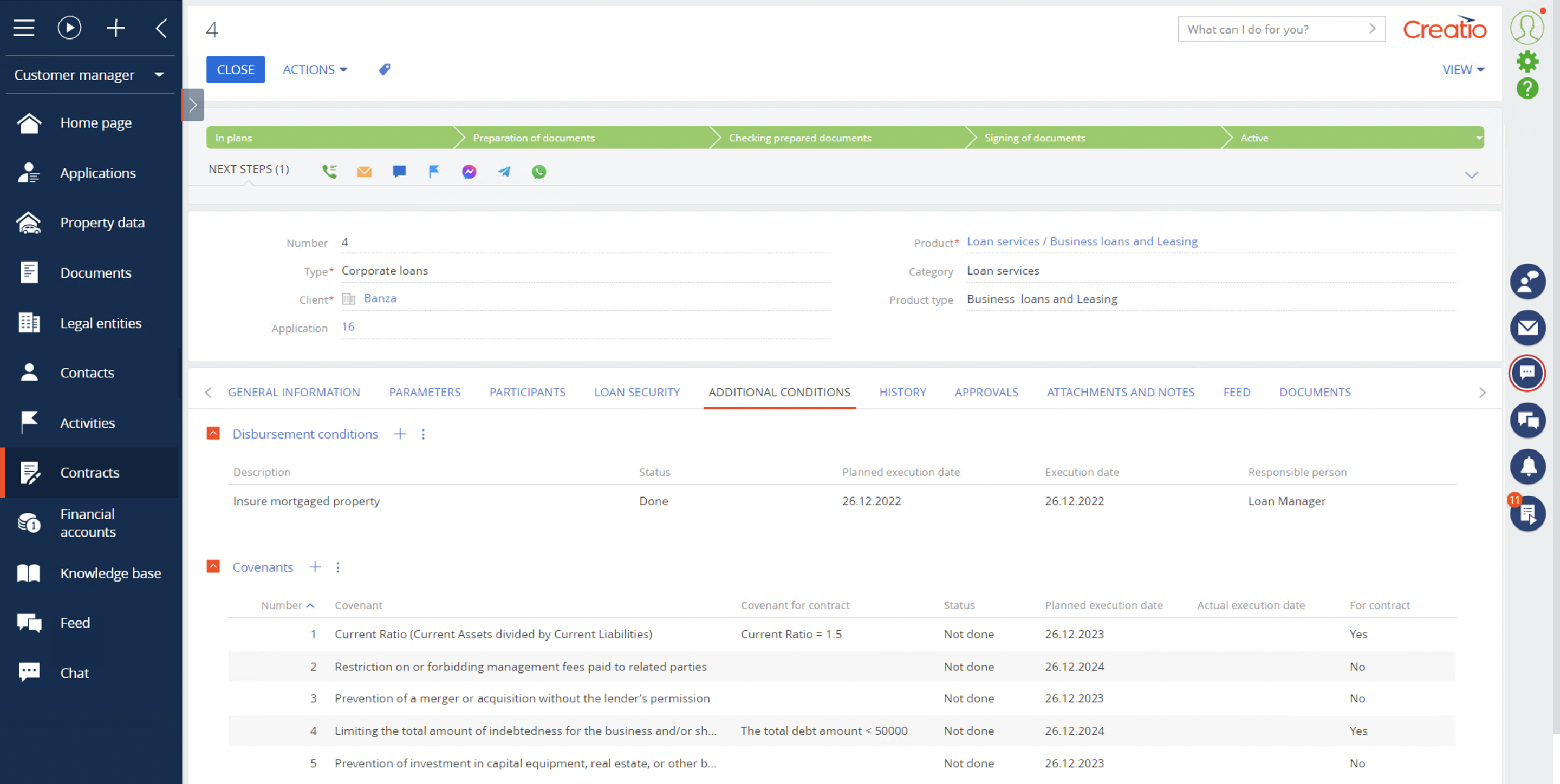

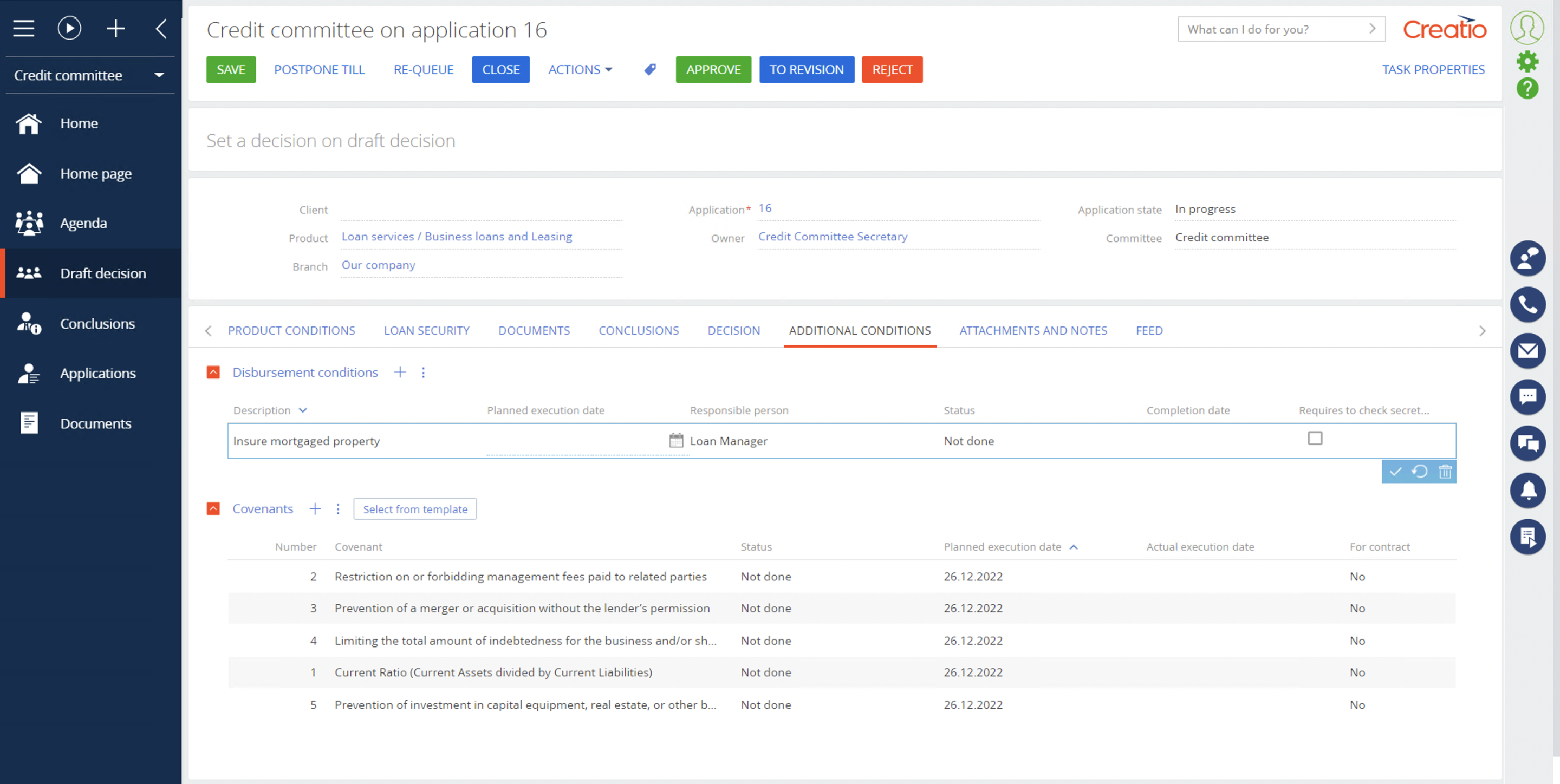

- Covenants and additional conditions management

- Automatic loan agreement

- Process of documentation preparation and approval for contract signing

Key features:

- Extended 360° customer view with manager, beneficiary and shareholder information

- Flexible segmentation tools

- Possibility to configure customer search conditions and parameters in search results

- Questionnaire pages for individuals, entrepreneurs and legal entities

- Possibility to configure property characteristics, assessment, and loan criteria

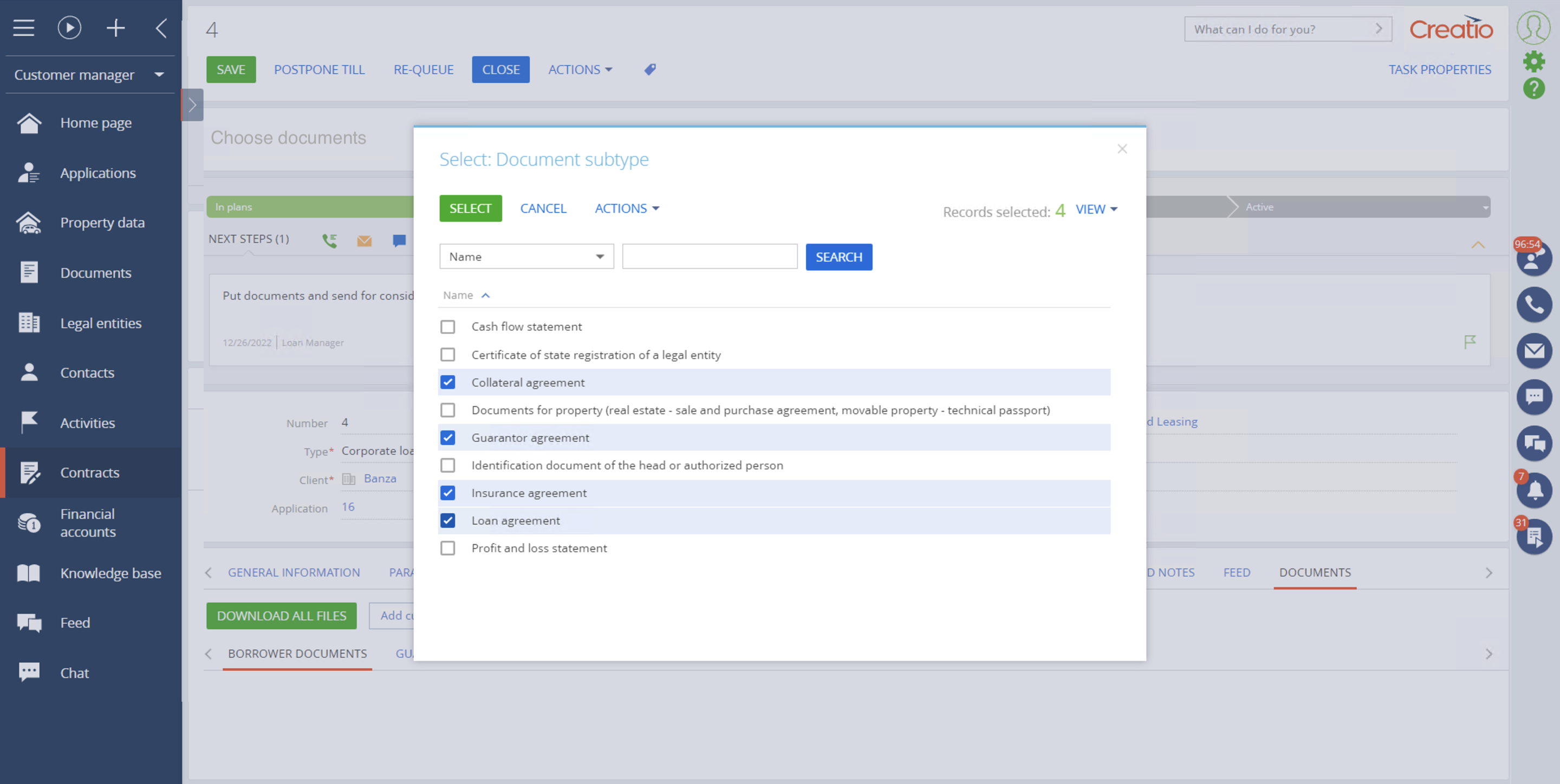

- Package set up of documents for borrowers, guarantors, pledgers, and other application participants

- Document management and the possibility of document approval by services

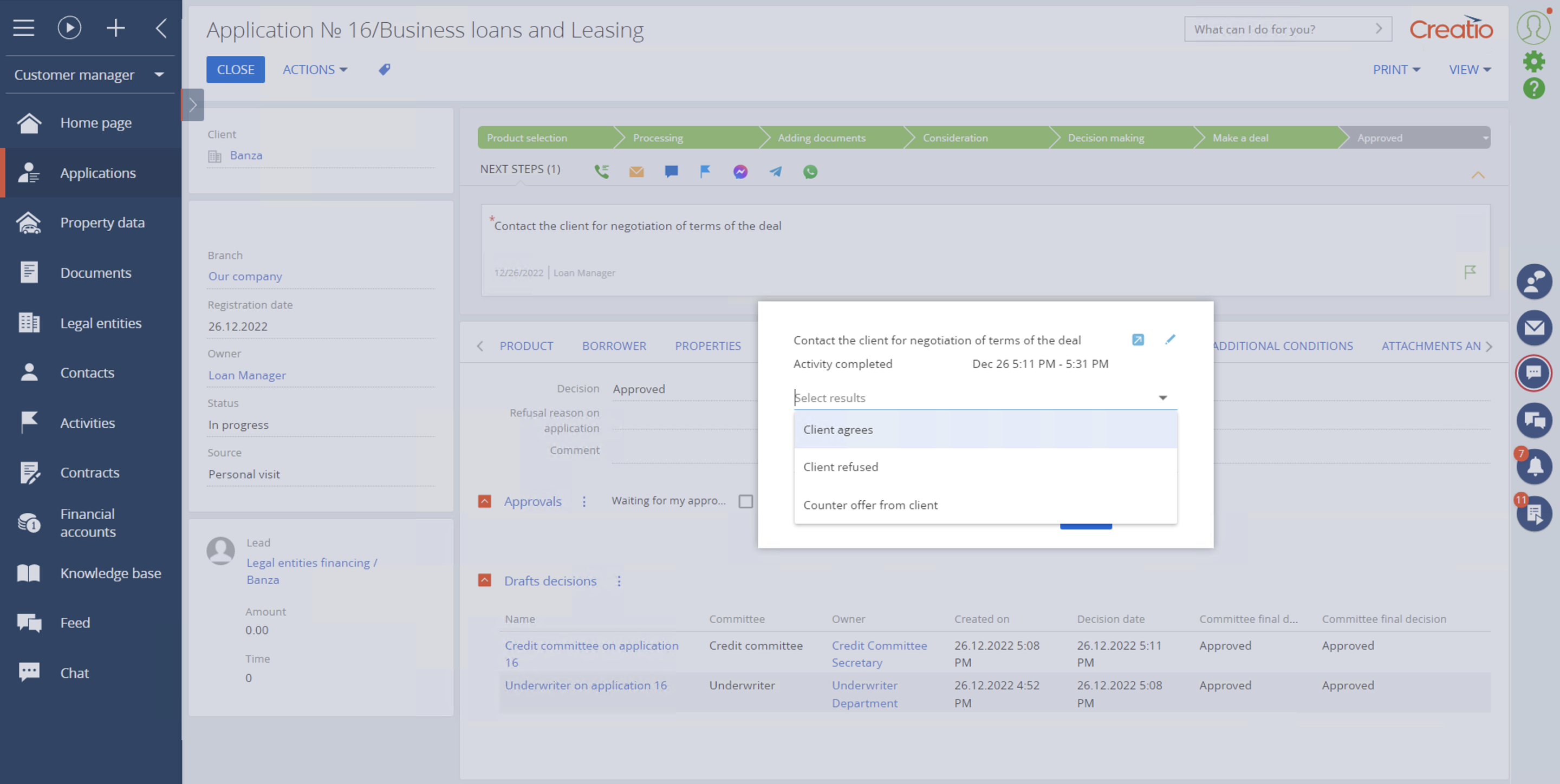

- Customizing different consideration routes for different segments of clients

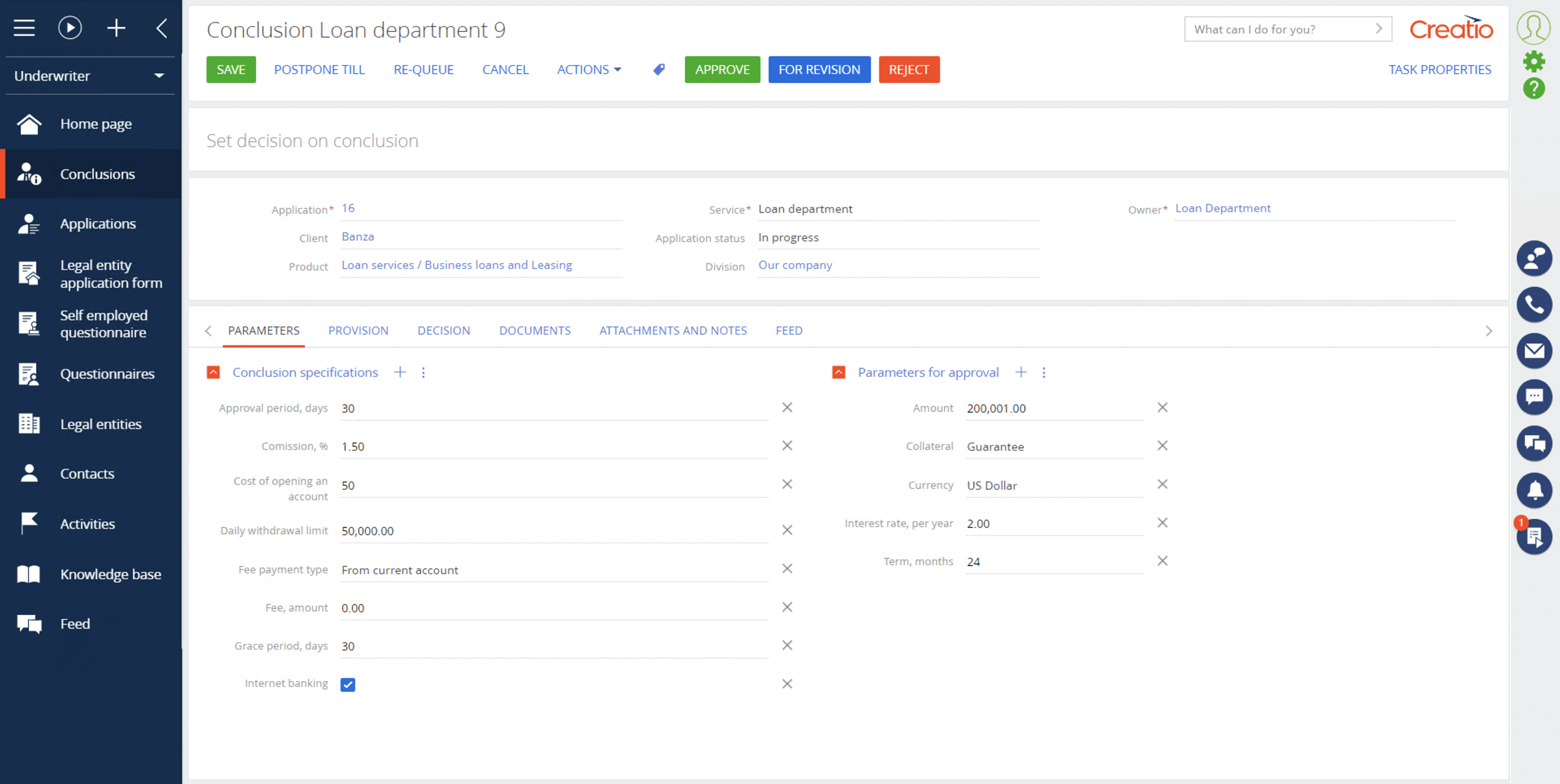

- Personalized pages for specialized services in the consideration stage

- Possibility of consecutive and parallel consideration by services

- Management of credit committee limits and setting up of levels and composition of credit committee members

- Drafting of decisions with the ability to add covenants and additional conditions for issuance

- Approval of product terms with the possibility to change the terms as necessary

- Automatically create loan contracts using data from the already agreed terms

- The process of preparing and approving loan and collateral documentation for signing contracts

- Assigning tasks to responsible employees and the ability to send specific documents for revision

Pricing

Monthly

Annual

Standard

$

5,050.00 / month

billed annually

Terms and Conditions

By installing this product you agree to terms and conditions outlined in the license agreement.

Pricing FAQ

How does pricing work?

What currencies are accepted for payment?

Do the listed prices include taxes or discounts?

Does the listed price include the cost of the Creatio Platform plan?

Support

Support is available for this application

Support is provided by the developer within the “Basic” and “Business” packages. Detailed information about the support packages and the support terms can be found on the Creatio website.

Installation

Data sharing

- By installing or downloading the App, you confirm that you agree with sharing your account data (name, email, phone, company and country) with the App Developer as their End User.

- The App Developer will process your data under their privacy policy.

Versions

Versions history

Version

Compatibility

Release date

1.5

8.0.1 and up

Manual app installation

- Open the needed app → the Packages tab - download the Markeplace app files.

- Click in the top right → Application Hub

- Click New application. This opens a window.

- Select Install from file and click Select in the window that opens.

- Click Select file on the page of the Marketplace App Installation Wizard and specify the app file path.