InterWeave Payment Gateway for Creatio

Overview

Product overview

InterWeave simplifies Payment and Subscription billing and management, automating recurring invoicing, payments and revenue recognition while streamlining customer revenue management.

Use Cases:

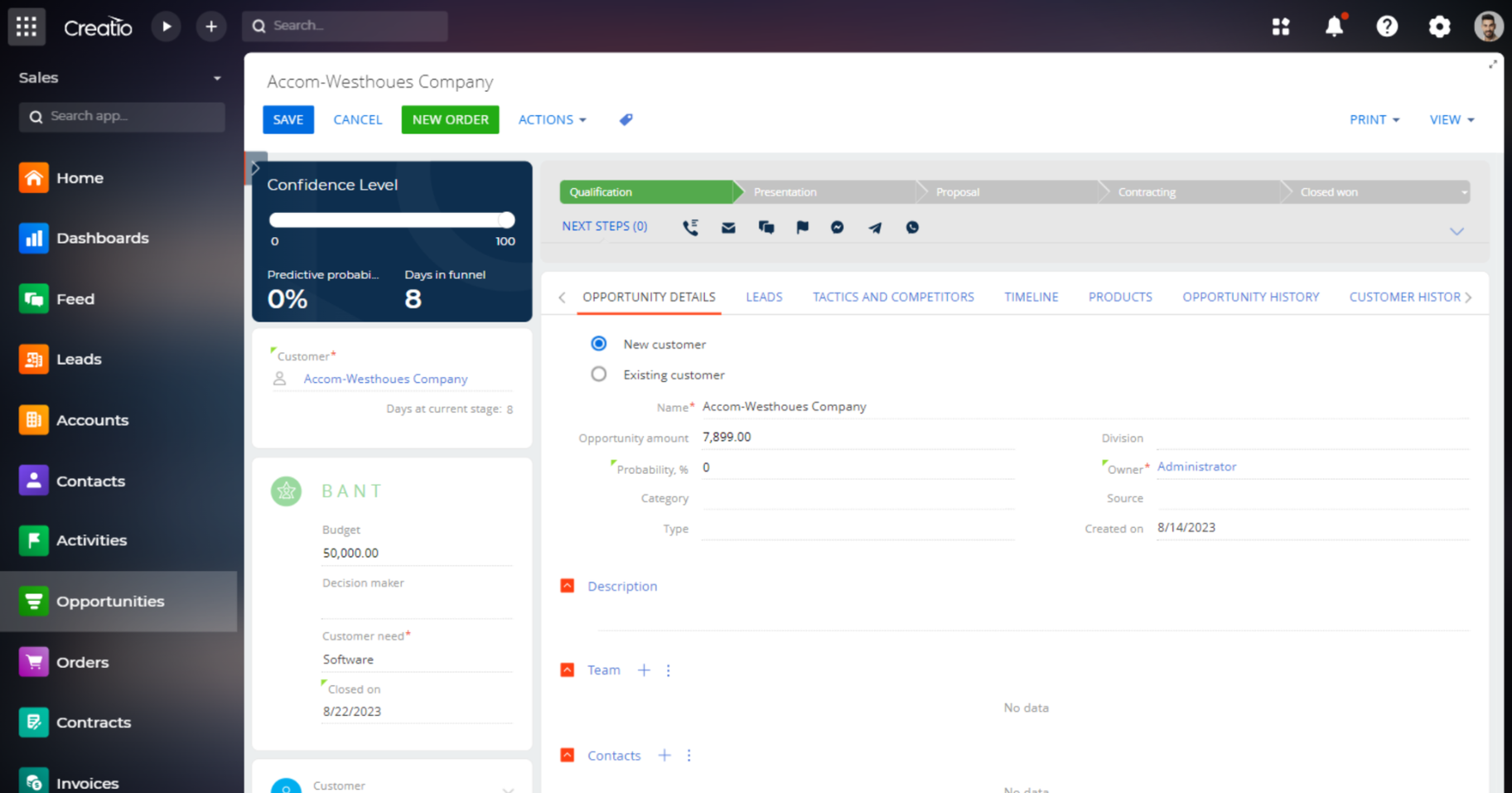

The InterWeave Payment Gateway is a powerful yet easy-to-use configurable integration delivered by means of InterWeave SMARTSolutions, a comprehensive SaaS Integration Platform, allowing for collecting payments from consumer bank or credit card accounts as well as data transfer between Creatio or websites to Merchant Providers.

Key Features:

Three distinct or combined options to set up the billing process of your online customers are available:

- Real-time Accept or Decline,

- Scheduled Payments - allow you to set up a remaining balance payment for a customer to execute automatically.

- Recurring Payments - If a customer is looking for a payment plan, Automated Recurring Billing (ARB) is a convenient and easy-to-use features submitting and managing recurring, or subscription-based transactions. Custom Recurring Billing (CRB) is a convenient way for managing recurring, or subscription-based transactions with custom schedules for your specific payment plan.

InterWeave Payment Gateway is integrated with Creatio and connects it with payment processors like:

- Authorize.net

- Transfirst

- Chase Paymenttech

- First Data

- PayPal

- Vanco

- iCash

- Payment XP

- Banktec

- Teledraft

- Cybersource

- and many more...

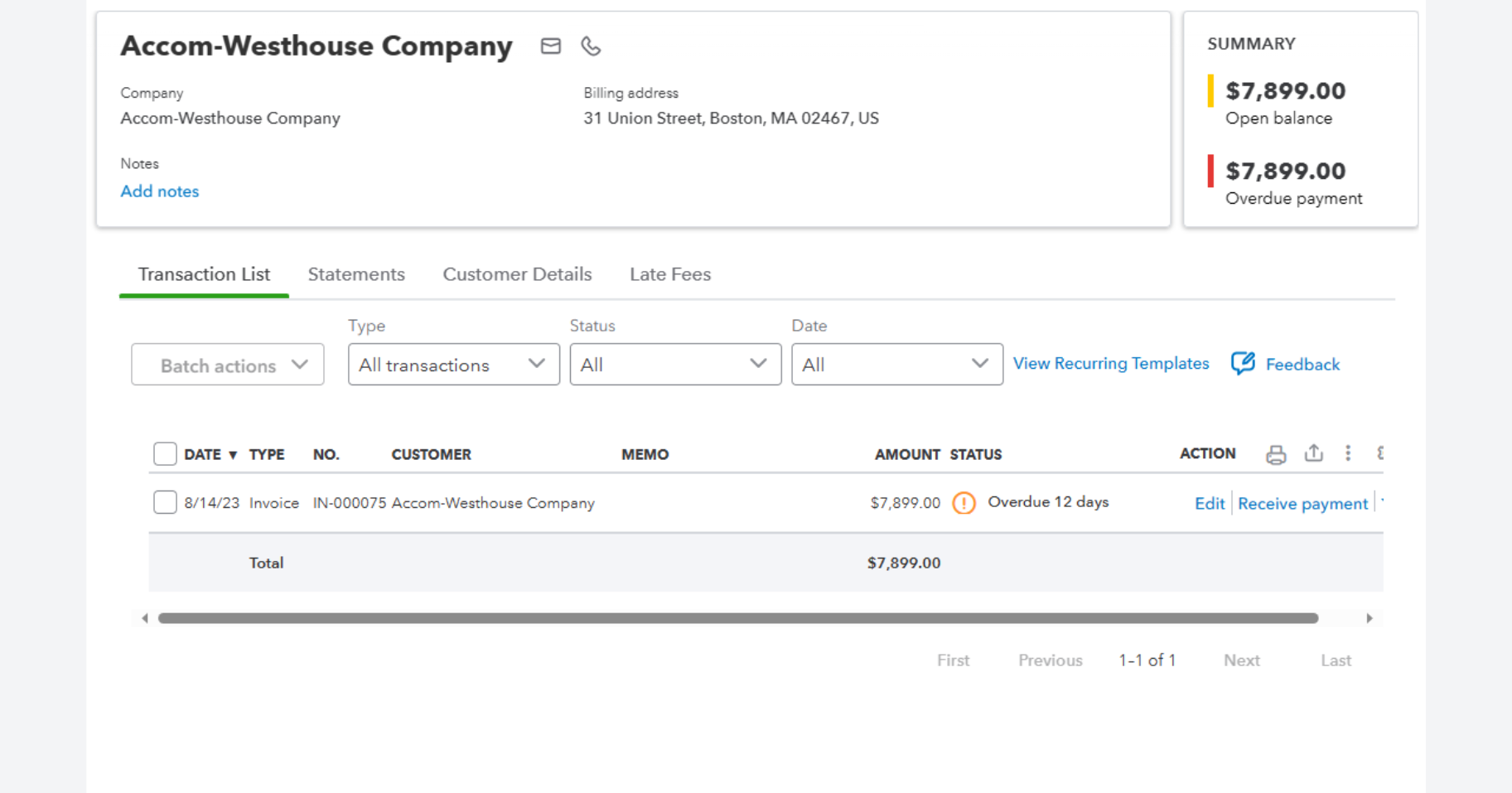

Flow of payment information and funds from Creatio or website to selected payment processors and back include the following steps:

Step 1: A customer submits a credit card or electronic check transaction on a website. The transaction then integrates with the selected payment processor (your MSP) via a secure connection.

Step 2: First Data receives the secure transaction information and passes it via a secure connection to your bank’s processor (a financial partner that provides credit card processing on behalf of the credit card associations, for example, Visa or MasterCard).

Step 3: Your bank’s processor submits the transaction to the Credit Card Interchange (a network of financial entities that communicate to manage the processing, clearing, and settlement of credit card transactions).

Step 4: The Credit Card Interchange routes the transaction to your customer’s Credit Card Issuer.

Step 5: The Credit Card Issuer approves or declines the transaction based on the customer’s available funds and passes the transaction results, and if approved, the appropriate funds, back through the Credit Card Interchange.

Step 6: The Credit Card Interchange relays the transaction results to your bank’s processor.

Step 7: Your bank’s processor relays the transaction results to your MSP.

Step 8: First Data stores the transaction results and sends them to you and/or your customer. This communication process averages three seconds or less!

Step 9: The Credit Card Interchange passes the appropriate funds for the transaction to your bank, which then deposits funds into your merchant bank account.

Notes:

- If you’re already selling products from a retail location, you probably have a Card Present (CP) merchant account. However, to sell from your website, you’ll also need a Card Not Present (CNP) merchant account. A CNP account is used by merchants that receive payments via the Internet or in situations when a payment is not physically presented to the merchant by the consumer at the time of the transaction (e.g. telephone orders).

- In the payments industry, Independent Sales Organizations (ISOs), Merchant Services Providers (MSPs), and Value-Add Resellers (VARs) are most often the organizations that provide merchant accounts. The First Data Directory located at http://www.firstdatacardprocessing.com/index.html and lists numerous such companies. You can also contact your current banking partner to find out if they provide CNP merchant accounts.

- The integration is implemented by means of the InterWeave SmartSolutions platform and provides the data structure, workflow and complex processing logic, support and security necessary to ensure fast, reliable and secure transmission of transaction data.

- InterWeave Payment Gateway manages the routing of transactions just like a traditional credit card swipe machine you find in the physical retail world, however, ISPG uses the Internet instead of a phone line.

- Once installed, InterWeave Payment Gateway is available 24/7 for processing transactions.

Pricing

Terms and Conditions

Pricing FAQ

Support

Installation

Setup guide

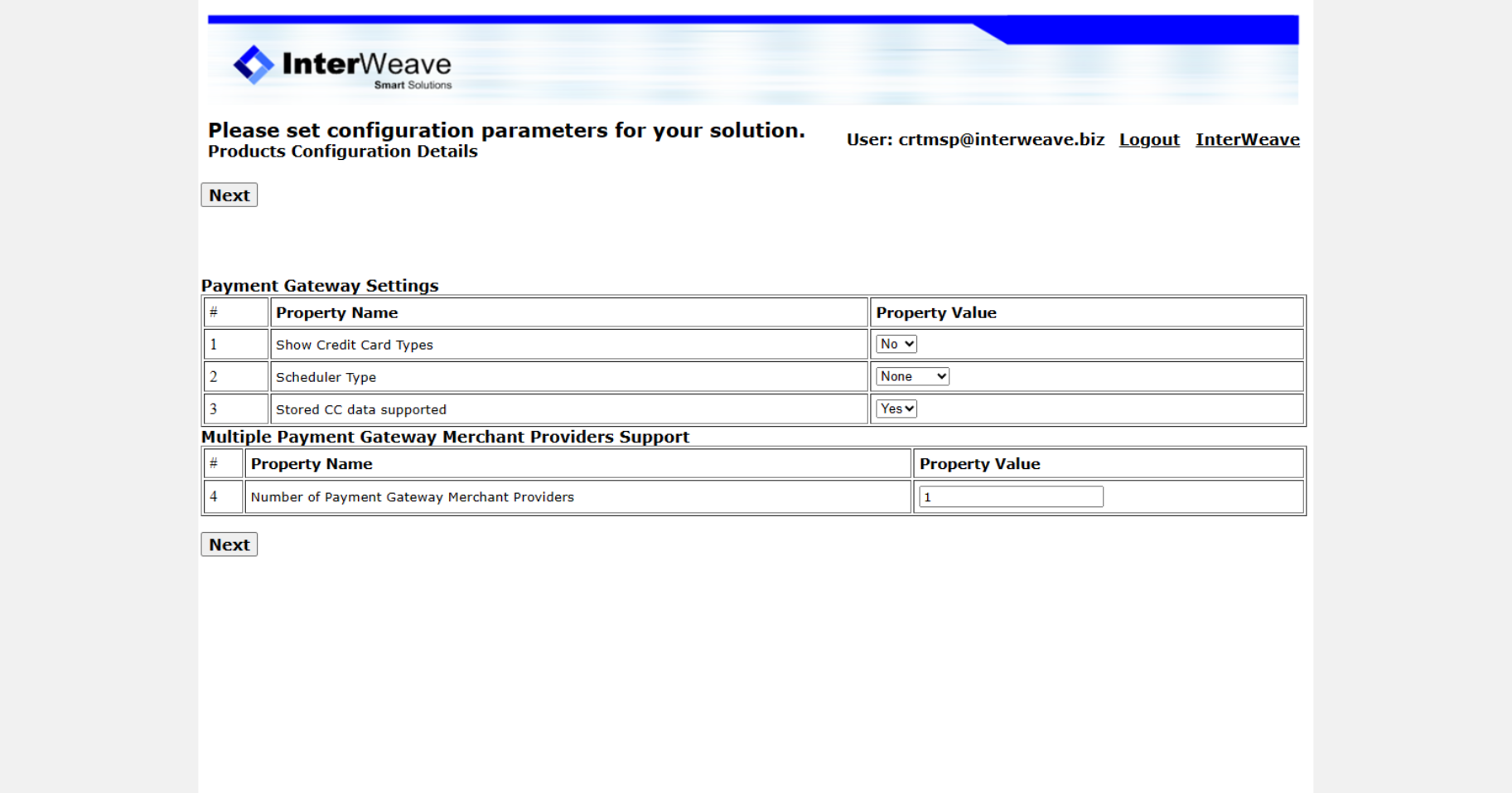

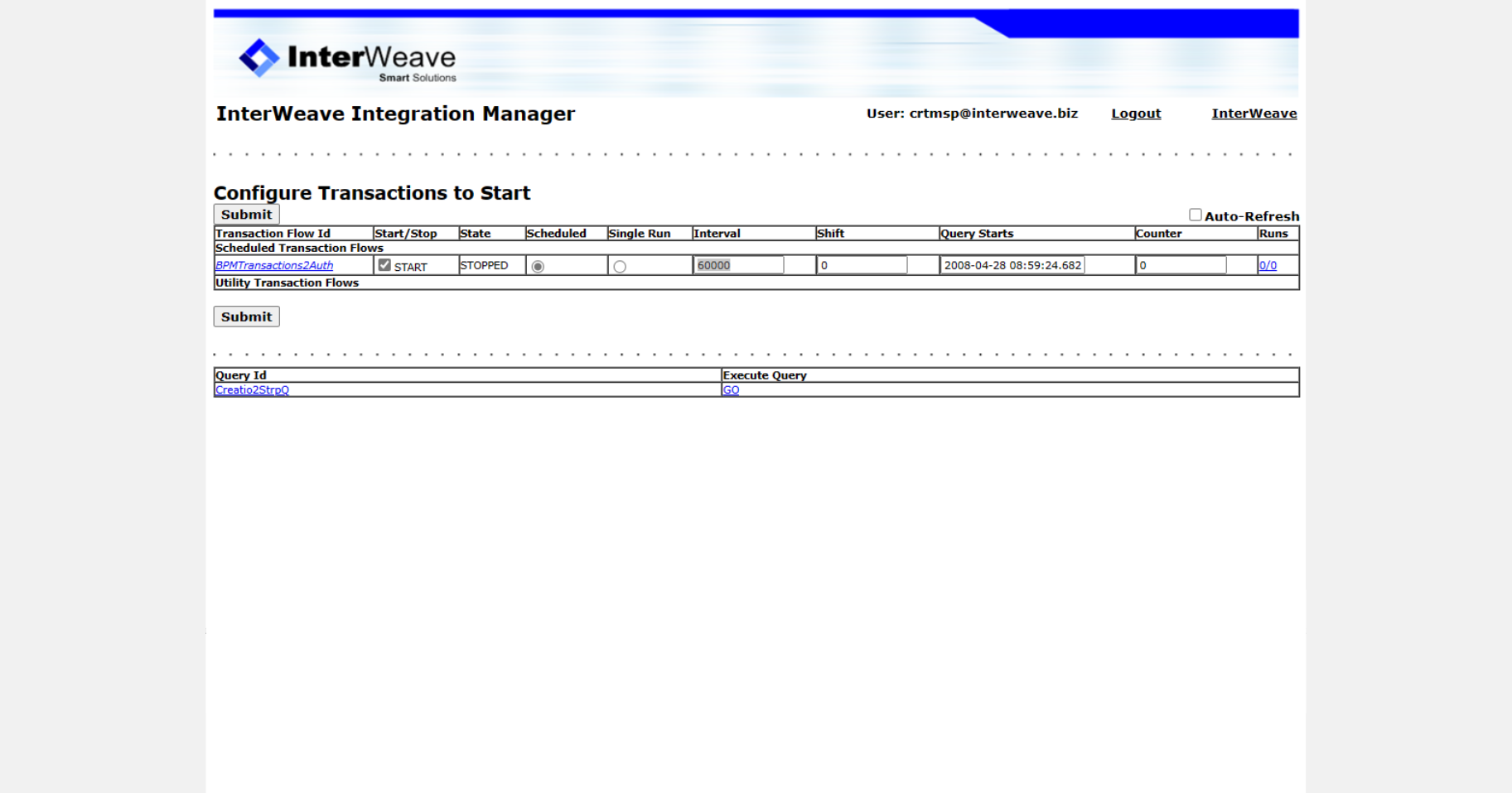

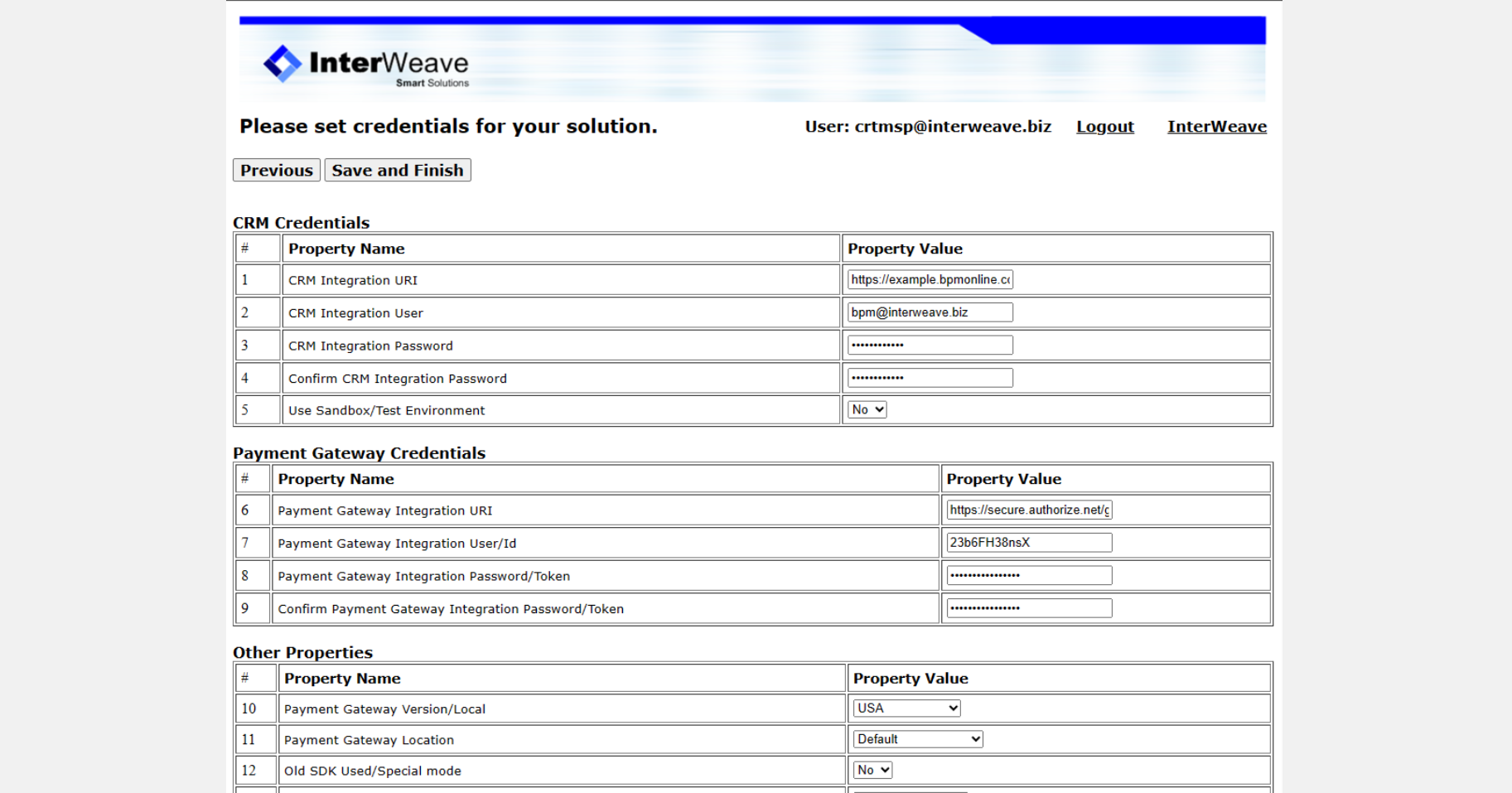

Your InterWeave SmartSolutions Support Personnel will work with you to establish and configure your SaaS, Hosted Solution integrating your Merchant Service Provider with Creatio and Merchant Service Provider. While activation requires only the provisioning of a Creatio instance and the installation of the selected InterWeave Solutions Configuration package, implementation of this full-fledged Solution does require an implementation project.

Due to the advantages of Creatio's low-code platform and InterWeave Solutions Configuration, implementation (i.e., "go live" for users) of InterWeave Solutions can be as rapid as 10 to 15 days, even less, depending on the amounts of process design, data conversions, and system integrations that are desired.

Please do contact InterWeave for approaches and estimates for implementation that are specific to your own organization's circumstances.

Resources

Data sharing

- By installing or downloading the App, you confirm that you agree with sharing your account data (name, email, phone, company and country) with the App Developer as their End User.

- The App Developer will process your data under their privacy policy.

Versions

Manual app installation

- Open the needed app → the Packages tab - download the Markeplace app files.

- Click in the top right → Application Hub

- Click New application. This opens a window.

- Select Install from file and click Select in the window that opens.

- Click Select file on the page of the Marketplace App Installation Wizard and specify the app file path.

Price Notes:

InterWeave Payment Gateway for Creatio integrates with all editions of Creatio.

* An active Creatio and Merchant Service Provider license is required. Implementation costs are not included in the subscription price.

** Creatio costs are not included in the indicated pricing.

*** MSP costs are not included in the indicated pricing.

InterWeave Support Notes:

*** Whereas InterWeave Payment Gateway for Creatio is an enterprise-grade application, implementation and leverage of which will vary greatly from organization to organization. Please contact InterWeave for implementation estimates that are appropriate to your own team's needs and plans.